Search For Homes Today

Search for the perfect home with our tool!

What’s My Home Worth?

Find Out Today

Mortgage Calculators

Get started by crunching some numbers!

Search for the perfect home with our tool!

Find Out Today

Get started by crunching some numbers!

Our team is united by our passion for finance and serving others, and by our desire to change the mortgage experience.

602-622-6514

James.Whitener@FairwayMC.com

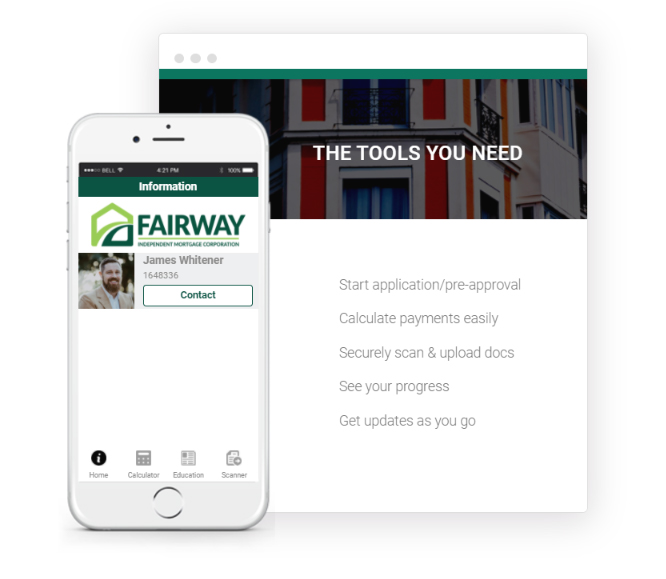

James Whitener – Loan Officer

20359 N. 59th Ave, Suite 100

Glendale, AZ 85308

602-622-6514

James.Whitener@FairwayMC.com

The content on this website is written by James and reflects his opinion, and not the opinion of Fairway Independent Mortgage Corporation.