Don’t leave your decisions to only what you read in the news. Do your Homework!

If you haven’t heard of or read about an inverted yield spread now is the time to get familiar. An inverted yield spread is an economic indicator that can predict a coming recession. This is absolutely vital for you to understand and review if you are considering purchase a home using a mortgage. It will guide your decisions in structuring the loan for your new home.

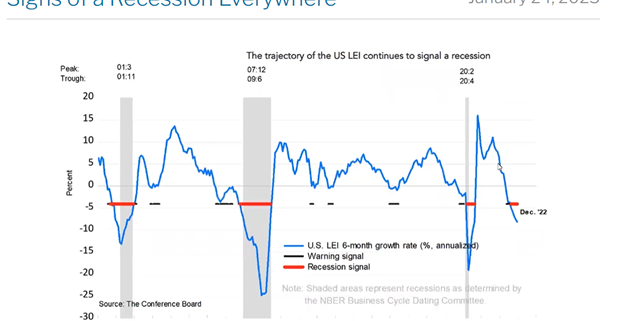

A very simple explanation is when interest rates on long term bonds fall lower than short term bonds. So if you are comparing the 10 year bond to the 2 year bond and the 10 year yield is lower than the 2 year yield it can start to be an indicator. Typically a recession is a year behind this yield curve inverting and as of right now we are 10 months into the start of this happening. With this in mind and the 60 year history we can show, it is a near inevitability that we are either in or heading into a recession.

What does this mean to you? Once it is recognized that we are in a recession we will start to see inflationary indicators drop, the manipulation of the rates removed and bond markets will react in favor of lower interest rates. If you consider this and the fact that lower rates will increase demand, now is a great time to buy, get seller contributions and refinance when rates are lower. We can always change the rate you have but we cannot change the price you pay and the amount of fees you pay on the day you close on your new home.

There are a lot of creative ways to have the current economic factors help you achieve your financial goals!

Leave a Reply

Want to join the discussion?Feel free to contribute!